Introduction

Married couples expecting a child can legally increase their parental allowance by changing their tax class before the child is born. The tax class affects the net salary, and the parental allowance is calculated based on the net salary before childbirth. If the parent who stays at home and receives parental benefits after the birth is in tax class 5 or 4 before the child is born, he or she can increase the parental allowance significantly by switching to tax class 3 at least six months before the maternity leave. In certain cases, this would lead to an increase in parental allowance of €400 per month.

Parental Allowance

While parents are receiving parental allowance (Elterngeld), they may work part-time. The condition is that they do not work more than 32 hours per week. Depending on the parent's income before the birth of their kid, the basic parental allowance ranges from €300 to €1,800 per month as of 2022. In most cases, it equals 65 percent of the parent's net income. Low-income parents can get up to 100% of their net income. If the parent did not have any income before to the delivery, he or she will get the bare minimum. If the couple has other young children or if the newborns are twins, they may be eligible for additional funds.

If both parents work part-time while receiving a parental allowance, the amount of parental allowance is reduced. In this case, the parent's income after the birth of the child is also taken into account when determining the parental allowance.

Parents receive the basic parental allowance for at least two months and a maximum of up until their child's first birthday. If both parents apply for parental allowance, they can receive it for a total of 14 months. Parents are free to divide the 14 months between themselves. They can receive the basic parental allowance together, one after the other, or alternately. Single parents are also entitled to an additional two months. More info on familienportal.de .

Case study

Let's consider the following example: Spouse 1 and Spouse 2 earn a gross monthly salary of €5,500 and €4,000 respectively. They change from the tax class combination of 3/5 to 5/3 six months before the maternity leave. In this way, they can increase the parental allowance for Spouse 2 from €1,334.40 to €1,799.85 . If Spouse 1 takes no parental leave and Spouse 2 takes twelve months, they can have an additional income of €5,025.85 after the child was born. Note that 12x€1,799.85-12x€1,334.40 actually equals to €5,585.4 . However, due to the progression clause (Progressionsvorbehalt), even if the taxable income is the same, the tax rate will increase due to the increased parental allowance.

€5,025.85

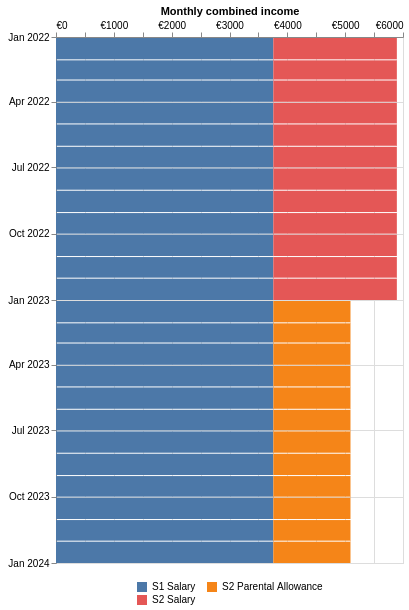

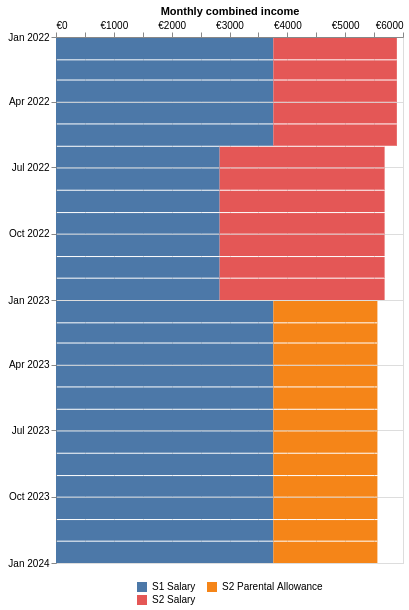

Using the Salary calculator for Germany , and assuming that the child will be born somewhere in January 2023, the income for the family is evaluated for two cases:

- Spouse 1 remains in tax bracket 3 and Spouse 2 remains in tax bracket 5 throughout the entire period,

- Spouse 1 is initially in tax bracket 3 and Spouse 2 is in tax bracket 5, and they change tax brackets seven months before the expected birth of the child.

The figures below show the monthly net income for the two evaluated cases for a two-year period:

As shown above, the monthly income decreases in the second case after switching tax classes. This is because the amount of tax deducted from Spouse 1's salary has increased. This loss, however, is only temporary because it can be claimed back after filing a joint tax return at the end of the tax year.

The side-by-side tables below provide a detailed calculation of taxes, parental allowance, and final income in both cases.

Income breakdown for tax class combination of 3/5

| First Year | Second Year | |

|---|---|---|

| Taxable Income* | €92,498.00 | €54,034.00 |

|

Child Allowance

|

-€0.00 | -€0.00 |

|

Parental Allowance

|

€0.00 | €16,012.80 |

|

Estimated Tax*

|

€20,942.00 | €10,165.49 |

|

Paid Tax

|

€20,885.00 | €8,276.00 |

| Tax Difference* | -€57.00 | -€1,889.49 |

| Income Breakdown | First Year | Second Year |

| Spouse 1 (S1) | ||

|

Salary in Tax Class 3/5

|

€45,090.59

|

€45,090.59

|

| Spouse 2 (S2) | ||

|

Salary in Tax Class 3/5

|

€25,635.00

|

€0.00

|

|

Parental Allowance

|

€0.00

|

€16,012.80

|

| Tax Difference* | -€57.00 | -€1,889.49 |

| Total Income* | €70,668.59 | €59,213.90 |

Income breakdown for tax class combination of 5/3

| First Year | Second Year | |

|---|---|---|

| Taxable Income* | €92,498.00 | €54,034.00 |

|

Child Allowance

|

-€0.00 | -€0.00 |

|

Parental Allowance

|

€0.00 | €21,598.20 |

|

Estimated Tax*

|

€20,942.00 | €10,725.04 |

|

Paid Tax

|

€22,367.22 | €8,276.00 |

| Tax Difference* | €1,425.22 | -€2,449.04 |

| Income Breakdown | First Year | Second Year |

| Spouse 1 (S1) | ||

|

Salary in Tax Class 3/5

|

€18,787.74

|

€45,090.59

|

|

Salary in Tax Class 5/3

|

€19,808.04

|

€0.00

|

| Spouse 2 (S2) | ||

|

Salary in Tax Class 3/5

|

€10,681.25

|

€0.00

|

|

Salary in Tax Class 5/3

|

€19,966.33

|

€0.00

|

|

Parental Allowance

|

€0.00

|

€21,598.20

|

| Tax Difference* | €1,425.22 | -€2,449.04 |

| Total Income* | €70,668.59 | €64,239.75 |

Notes

Note that a change of tax class is possible only for the next month, regardless of when in the month the documents are submitted. There are also exceptions, such as, newlywed couples can change tax class retrospectively.

Not always needed to be in tax class 3 for 6 months. The spouse who receives parental benefits was in more than one tax class during the parental allowance assessment period. Example: the spouse was in tax class 1 for four months before marriage, then changed to tax class 4 for three months after marriage, then the spouse only has to be in tax class 3 for four months.

The couple shall switch to the desired tax classes as soon as they learn of the pregnancy, to ensure that the last six payments from the employer before the start of maternity leave fall into the most favorable tax bracket.

*Disclaimer

The Taxable Income, Estimated Tax, Tax Difference, and Parental Allowance are all approximations. The Estimated Tax does not include additional incomes or special tax-deductible expenses. Only the respective authorities can provide the final values for tax and parental allowance. This calculation should act only as a guideline. We do not claim complete accuracy for this calculation.