Introduction

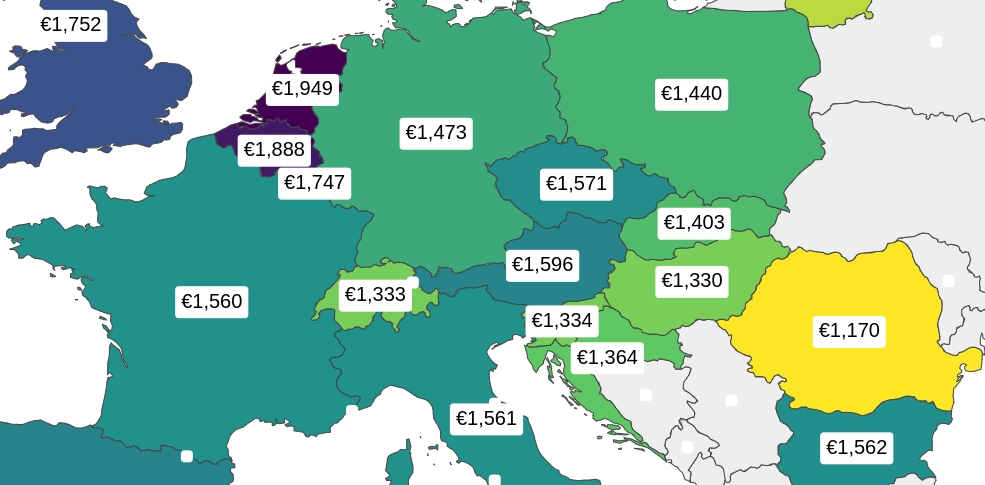

Discover the net salaries in various European countries through our latest analysis. The visualisations below demonstrate the effects of taxes and social security deductions on net pay.

Our insights provide valuable information on the financial considerations of individuals who have the freedom to move seamlessly across borders in the context of EU free movement. Our interactive charts offer valuable insights into potential net income, whether you are a digital nomad seeking a location-independent career or considering a move to another European country within your company or for any other reasons.

Person Profile

In this scenario, the individual is unmarried, without children or dependents, aged 30, residing in the capital city, and holds no religious affiliations. Moreover, there is no provision for vacation allowance or a 13th salary.

Data Visualizations

Data Source

| Country | Source | Notes |

|---|---|---|

| 🇦🇹 Austria | https://bruttonetto.arbeiterkammer.at/ | |

| 🇧🇪 Belgium | https://www.diecsc.be/apps/berechnen-sie-ihren-nettolohn | |

| 🇧🇬 Bulgaria | https://kik-info.com/trz/zaplata-bruto.php | - 1 EUR = 1.96 BGN (17.01.2024) - For incomes exceeding 3700 BGN, while social insurance taxes are capped, the income tax is also limited to 10%. |

| 🇭🇷 Croatia | https://bruto.kuk.is/hr | 1 EUR = 7.63773 HRK (17.01.2024) |

| 🇨🇾 Cyprus | https://www.cyprustaxcalculator.com/ | |

| 🇨🇿 Czech Republic | https://www.vypocet.cz/cista-mzda | 1 EUR = 24.75 CZK (17.01.2024) |

| 🇩🇰 Denmark | https://hvormegetefterskat.dk/ | 1 EUR = 7.45835 DKK (17.01.2024) |

| 🇪🇪 Estonia | https://www.kalkulaator.ee/et/palgakalkulaator | |

| 🇫🇷 France | https://calcul-salaire-brut-en-net.fr/ | |

| 🇩🇪 Germany | https://lohntastik.de | |

| 🇬🇷 Greece | https://www.mikta-kathara.gr/ | |

| 🇭🇺 Hungary | https://www.hrportal.hu/berkalkulator.html | 1 EUR = 380.81500 HUF (17.01.2024) |

| 🇮🇸 Iceland | https://virtus.is/en/ | 1 EUR = 148.33000 ISK (24.01.2024) |

| 🇮🇹 Italy | https://www.calcolastipendionetto.it/ | |

| 🇱🇻 Latvia | https://kalkulatori.lv/lv/algas-kalkulators | |

| 🇱🇹 Lithuania | https://www.tax.lt/skaiciuokles/atlyginimo_ir_mokesciu_skaiciuokle | |

| 🇱🇺 Luxembourg | https://www.calculatrice.lu/steuerrechner | |

| 🇲🇹 Malta | https://maltasalary.com/ | |

| 🇳🇱 Netherlands | https://thetax.nl/ | Additinal 150 EUR is deducted as healthcare insurance (https://www.fbto.nl/). |

| 🇵🇱 Poland | https://wynagrodzenia.pl/kalkulator-wynagrodzen/wyniki | 1 EUR = 4.40065 PLN (17.01.2024) |

| 🇵🇹 Portugal | https://www.comparaja.pt/simuladores/calculadora-salario-liquido | |

| 🇷🇴 Romania | https://www.calculator-salarii.ro/calcul-salariu-net/ | 1 EUR = 4.9752 RON (18.01.2024) |

| 🇸🇰 Slovakia | https://www.platy.sk/vypocet-mzdy/vysledky | |

| 🇸🇮 Slovenia | https://www.optius.com/iskalci/karierna-svetovalnica/kalkulator-za-izracun-bruto-neto-place/ | |

| 🇪🇸 Spain | https://cincodias.elpais.com/herramientas/calculadora-sueldo-neto/ | |

| 🇸🇪 Sweden | https://statsskuld.se/jobb/berakna-nettolon | 1 EUR = 11.37250 SEK (18.01.2024) |

| 🇨🇭 Switzerland | https://www.lohncomputer.ch/en/your-result/ | 1 EUR = 0.94387 CHF (24.01.2024) 400 EUR also deducted as health insurance expenses. |

| 🇬🇧 United Kingdom | https://www.income-tax.co.uk/ | 1 EUR = 0.85569 GBP (24.01.2024) |

Your Finance Toolkit

Banking & Finance

A reliable bank account is the foundation of your life in Germany. DKB offers a top-tier free account with a Visa Debit card, free worldwide payments, and attractive interest rates.

DKB.de - Free AccountTax Return

Easily claim back overpaid taxes. Whether conveniently via app or with professional software – use the best tools to maximize your refund.

Comparison

Save hundreds of Euros details annually by comparing rates. Tarifcheck, Verivox and CHECK24 ensure transparency for car insurance, loans, electricity, gas, and internet – fast, secure, and free.

Insurance

Protect yourself against financial risks. From private liability, legal protection and dental coverage to full private health insurance (PKV) from experts like Ottonova, AXA, HanseMerkur or KS Auxilia.